“What’s Coming Is WORSE Than A Recession…” | Elon Musk’s Last WARNING | Big Money Investing Review

Video Transcript

Welcome to Big Money Investing

Your Ultimate Destination for Learning From Big Money and How You Can Succeed Too!

Are you ready to take it to the next level?

Investing into sound investments like big money does. Subscribe to the Big Money Investing Channel

well I think it does seem like we’re headed into a recession here the magnitude of that recession is debatable but I think it’s at least a light to moderate recession potentially it’s on the order of 2009 so I think it’s wise to kind of like prepare for the worst hope for the best prepare for the worst don’t get too adventurous like watch out for margin debt I would really advise people to not have margin debt in a volatile stock market and you know from a cash standpoint keep powder dry you can get some pretty extreme things happening in a down Market like Brett Johnson who was a CFO of SpaceX was at um broadcom in 2000 and he said that uh and that’s a good company making good products and he said the from Peak to trough I think in less than 12 months Brom went down 97% so like even if you had a small Marin loan there you got you got crushed it subsequently recovered and I think you know to much higher levels but you know if there’s like mass panic in the stock market uh then you got to be really be careful about margin de but I mean this is just as we know the economy is Cy cck and somewhat overdue for a recession and my best guess is that you know we have sort of Stormy times for a year or to a year and a half and then things start to Dawn breaks recessions don’t like like booms don’t last forever but neither do recessions and it’s a 14-year boom so a six quarter recession seems like yeah that might actually bounce out the last time it was what four or five quarters so it’s it’s it’s not easy America is also going bankrupt extremely quickly everyone seems to be sort of whistling past the graveyard on this one they’re all grabbing the silverware everyone’s stuff in their pockets of the silverware before this Titanic sinks the defense department budget is a very big budget okay it’s a trillion dollars a year DOD Intel it’s a trillion dollars and interest payments on the national debt just exceeded the defense department budget they’re over a trillion dollars a year just in interest and Rising we’re adding a trillion dollars to our debt which our you know kids and grandkids are going to have to pay somehow every 3 months and then soon it’s going to be every two months and then every month and then the only thing we’ll be able to pay his interest it’s just like a person at scale that has racked up too much credit card debt and uh this does not have a good ending we have to reduce the spending the counter argument I hear from a lot of politicians is if we reduce spending because right now if you add up federal state and local government spending it’s between 40 and 50% of GDP so nearly half of our economy is supported by government spending and nearly half of people in the United States are dependent directly or indirectly on government checks either through contractors that the government pays or they’re employed by government entity so if you go in and you take to harden act too fast you will have significant contraction job loss and recession what’s The Balancing Act Elon just thinking realistically because I’m 100% on board with you how do you really address it when so much of the economy and so many people’s jobs and livelihood are dependent on government spending well I do think it’s sort of false dichotomy it’s not like no government spending is going to happen you really have to say like is at the right level and just remember that any given person if they are doing things in a less efficient organization versus more efficient organization their contribution to the economy their net output of goods and services will reduce I mean you’ve got a couple of clear examples between East Germany and West Germany North Korea and South Korea I mean North Korea they’re starving South Korea it’s like amazing the compounding effect productivity gains yeah yeah it’s night and day and so in the North Korea you’ve got 100% government in South Korea you’ve got probably I don’t know 40% government it’s not zero and yet you’ve got a standard of living that is probably 10 times higher in South Korea at least at least exactly and then East and West Germany in West Germany you had just thinking in terms of cars I mean you had BMW Porsche Audi Mercedes and East Germany which is a random line on a map the only car you could get was a trabant which is basically a lawn mower with a shell on it and it was extremely unsafe there was a 20year wait so like you know put your kid on the list as soon as they’re conceived and even then only I think you know a quarter of people maybe got this lousy car that’s just an interesting example of like basically the same people different operating system and it’s not like West Germany was some you know a capitalist Heaven it was it’s quite socialist actually so probably it was half government in West Germany and 100% governor in East Germany and again sort of a at least a 5 to 10x standard of living difference and even qualitatively vastly better it’s obviously you know some people have these amazingly in this modern era this debate as to which system is better well I’ll tell you which system is better the one that doesn’t need to build the wall to keep people in okay that’s how you can tell it’s a dead giveaway you have to build a barrier to keep people in that is the bad system there wasn’t West berin that built the wall okay they were like you know anyone who wants to flee West go ahead and if you look at sort of the flux of boats from Cuba there’s a large number of boats it’s from Cuba and there’s a bunch of free boats that anyone can take back to Cuba like plenty of seats there’s like hey wow an abandoned boat I could use this boat to go to Cuba where they have communism awesome and yet nobody picks up those boats and it does it amazing if we cut government spending in half jobs will be created fast enough to make up for obviously you know I’m not suggesting that people have immediately you know tossed out with no sance and you know can’t pay their mortgage they you see some reasonable offramp where they’re still receiving money but have like I don’t know a year or two to find jobs in the private sector which they will find and then they will be in a different operating system and again you can see the difference East Germany was incorporated into West Germany living standards in East Germany Rose dramatically the SE number of disgruntled workers one government employees is quite a scary number I mean I might not make it you know the thing is that if it’s not done if you have a once in a lifetime or once in a generation opportunity and you don’t take Serious action you have four years to get it done and if it doesn’t get done then no I I think actually the reality is that if we get rid of nonsense regulations and shift people from the government sector to the private sector we will have immense prosperity and I think we’ll have a golden age in this country and it’ll be fantastic you know the government is more competent than it is I’m not saying that there aren’t competent people in the government they’re just in an operating system that is inefficient once you move them to a more efficient operating system their output is dramatically greater as we’ve seen when East Germany was reintegrated with West Germany and the same people were vastly more prosperous with a basic half capitalist operating system for a lot of people their maybe most direct experience with the government is the DMV and then the important thing to remember is the government is the DMV at scale how much do you want to scale it it’s been a long time since there was a serious effort to reduce the size of government and to remove absurd regulations and you know the last time there was a really concerted effort on that front was Reagan in the early ‘ 80s we’re 40 years away from a serious effort to remove regul that don’t Ser the greater good and reduce the size of government and I think it’s just if we don’t do that then what’s happening is that we get regulations and lows accumulating every year until eventually everything’s illegal and that’s why we can’t get major infrastructure projects done in the United States like if you look at the absurdity of the California highspeed rail I think they they spent $7 billion and have A600 put segment that doesn’t actually have rail in it I mean your tax dollars at work I mean that’s an expense of 1600 fet concrete you know I realize sometimes I’m perhaps a little optimistic with schedules but I wouldn’t be doing the things I’m doing if I was uh you know not an optimist but at the current Trend you know California High Street rail might finish sometime next Century maybe probably not we’ll have teleportation by that time so yeah exactly AI do everything at that point I think you really think of the United States and many countries it’s arguably worse in the EU as being like glier tied down by a million little strings and like any one given regulation is not that bad but you’ve got a million of them or Millions actually then then eventually you just can’t get anything done this is a massive tax on the consumer on the people it just didn’t didn’t realize that there’s this massive tax in the form of irrational regulation I’m going to give you a recent example that is just insane is that uh like SpaceX was fined by the EPA $140,000 for they claimed dumping portable water on the ground drinking water and we’re like this is star base and we’re like we’re in a tropical thunderstorm region that stuff comes from the sky all the time and there was no actual harm done you know it was just water to cool the launch pad during liftoff there’s zero harm done they agree yes there’s zero harm done we’re like okay so there’s no harm done you want us to pay $140,000 fine it’s like yes cuz you didn’t have a permit okay we didn’t know there was a permit needed for zero harm fresh water being on the ground in a place where fresh water falls from the sky all the time next to the ocean I mean s as it rain so much the roads are flooded so we’re like how does this make any sense they were like well we’re not going to process any more of your applications for launch for Starship launch unless you pay this $140,000 they just ransomed us and we like okay so we paid $140,000 but it’s like this is no good I mean at this rate we’re never going to get to Mars the sensible deregulation and reduction in the size of government is just like be very public about it and say like which of these rules if the public is really excited about a rule and wants to keep it we’ll just keep it and here the thing about the rules if the rule is you know turns out to be a bad we put it right back and then you know problem solved it’s like it’s easy to add rules but we don’t actually have a process we getting rid of them that’s the issue there’s no garbage collection Ru interest rat has been rising that increased the cost of the consumer of getting loans things like that we’ve had a stock market correction really a crash in a lot of gross stocks software stocks from where you sit and the data that you see where do you think the economy is headed right now do you think we’re in a recession or is it just a risk how do you assess our current economic situation well predicting economic rro economics is always difficult um and one should assign probabilities to these things now the thing is that recessions are not necessarily a bad thing now I’ve been through a few of them and what tends to happen is if you have a boom that goes on for too long you get misallocation of capital it starts raining money on fools basically it’s like any dumb thing gets money and I’m sure you’ve seen a few of those so at some point it gets just out of control and you just have a misallocation of human capital where people are doing things that are silly and not useful to their fellow human beings and then those compan there needs to be sort of an economic Ena if you will um to have everyone sort of shi uncomfortably in their seats um so but but the eventually the economic enema does its job a clears out the pipes if you will yes and sort of the the companies go bankrupt and the ones that are doing useful products are prosperous and um but there’s certainly a lesson here that if one is making useful product and has a that makes sense make sure you’re not running things too close to the edge from a capital standpoint you’ve got some Capital reserves to last through irrational times because in the past when there’s been a recession um it has gone it’s it’s amazing it’s flipped like a light switch I mean David you remember this when from the from the PayPal you know X PayPal days when we raised $100 million in March of 2000 and we literally we had the demand was so high we had people like VCS like just literally without even a term sheet wiring money into our account um they literally would like sleuth out our bank account number and wire money in and we’re like where’ this come from and it’s like oh so it was like there was literally fire hosing money in March of 2000 and and then in April 2000 the market went into free fall and it went from money raising money was trivial to even good companies could not raise money in a month so it’s just important to bear in mind like that you know PayPal almost went bankrupt in 2000 uh came close but thankfully we raised that $100 million in March 2000 without which we would be uh would game over basically um and we kind of saw it coming so it’s like we got that the ex confinity merger done in like three weeks and raised $100 million because we all like uh oh we see this coming to an end pretty soon and then a month later it was like you know a nightmare basically and uh make sure if you’re a healthy company you got some Capital to get through things and then what’s your costs and uh if it is a recession which more likely than not it is a recession not saying it is but it probably is um then just watch your cash flow and get dep positive cash flow as soon as you can so I think we probably are in a recession and that recession will get worse um but you know these things pass and then there will be room times gain um so it’ll probably be some tough going for I don’t know a year maybe maybe you know 12 to 18 months is usually the amount of time that takes for a correction to happen federal budget deficit is insane you know it’s like $3 trillion Federal expenditures are 7 trillion federal revenue is 4 trillion that’s a $3 trillion difference in if this was a company it’ be a $3 trillion loss so I don’t know if we should be adding to that loss that seems pretty crazy um something’s got to give you can’t just spend $3 trillion more than you earn every year and don’t expect something bad to happen I think you know this is not good the deficit is more than 3 trillion when you look at the future obligations so it’s 7 trillion of current expend expenditures but it’s much more than that if you look at Future obligations for Social Security Medicare and so forth so we’re running this incredible deficit someone’s got to give I don’t know let’s just can’t keep going the obvious reason for inflation is that the government printed a zillion amount of more money than it had obviously it’s like the government can’t just you know have issue checks for in excessive Revenue without there being inflation you know velocity of money held constant so unless there something would change with velocity of money but if federal government writes checks they never bounce so that is effectively creation of more dollars and if there are more dollars created then the increase in the goods and services outg of the economy then you have inflation again Lusty money held constant but this is very basic this is not like you know super complicated and if the government could just issue massive amounts of money and deficits didn’t matter then why don’t we just make the deficit a 100 times bigger okay the answer is you can’t because it will basically turn the dollar into something that is worthless and various countries tried this experiment multiple times it’s not like oh I wonder what happens if this is done have you seen Venezuela like the poor people of Venezuela are you know have been just run rough shot by their government and so obviously you can’t simply create money the true economy is very important like the true economy is the output of goods and services it’s not money it’s literally what is the output of goods and services money is simply a way for us to or anything that you call money is a way for us to conveniently Exchange change goods and services without having to engage in B and also to shift obligations in time those are the two reasons that you have money this thing called money it’s really it’s a database money is an information system for labor allocation and for exchange of goods and services and for translating in time and the quality of that information is a function of it’s like you basically you can apply information Theory to money and I think it helps explain why one money system is or why one action is better than another and so just like a an internet connection you’d want something that’s high bandwidth low latency and Jitter and is not dropping packets there not having a lot of errors in the system and the same is true of money and really like you said what did PayPal really really do that helped improve the bandwidth the speed at which money could move instead of mailing checks back and forth which amazingly that was what people did in 2000 you could now do realtime exchange of money and now you could ship your goods immediately instead of mailing a check and waiting for the bank to clear the check so the ultimate thing that with PayPal if it sort of was in the x.com less sort of Niche payments and more sort of broad Financial would be to Simply justes need to mediate all the heterogeneous uh Cobalt databases out there running on mainframes doing batch processing and have a single realtime system that was Secure and not batch processing so it would just be from an information standpoint more efficient and eventually it would all the bash processing cobal mainframes operated by the Banks would cease to exist I sure hope we don’t even need a war um there will will be certainly you know an economic competition that I think will blow people away when they realize just how competitive they have to be to be competitive with companies in China it’s very difficult you know Tesla is competitive because we have an awesome team in China Tesla is sort of pretty far out there in terms of work ethic anywhere in the world so I the T of work ethic in the US I think is substantially greater than any other car company or or any Lodge Manufacturing company that I’m aware of look I think it you know the point point of a company is to produce useful products and services for your fellow human beings it is not you know some political Gathering Place or a thing where it that’s the point of a company I’d say like it’s you know politics and other stuff should let’s not lose sight of why companies should exist I have been guiding our portfolio company CEOs to be at cash flow break even now or extend Runway to q1 2025 well Elon and I are kind of roughly in the same place we have been for a while which is like you need to give two to 3 qu of buffer so that you can go and raise around which takes a quarter to two quarters and once you start to get kind of get escape velocity out of a recession having money through end of q1 2025 I think is a minimum requirement and you know of the companies that I think were the most precariously positioned there was five of them that got their acts together and really did it but these are all CEOs of companies that you know I mean if you said them you would know some of them yeah I said Stan uh dren Miller he as you recall he predicted that inflation would be lasting this was in the spring of 2021 when transitory was the word of the day this year he predicted the bare Market rally we had in July and August and I remember back at The kotu Summit in May or around that time he was interviewed and he basically was saying that as soon as there was a bare Market rally over the summer that he would then put a short position on I don’t know if he actually did that but he said he was going to do that and then it turns out that the summer rally we had was a dead cap bounce so he was right about that and now he is predicting a hard Landing with a deeper recession than many expect so sadly I suspect he may be right yet again fredberg best investor for you I had rucken Miller I indicated that he’s been doing interviews pretty much every quarter for the last two years and he’s been pounding the table telling everyone what’s going to happen and it all happened and he even told people the trades he said he was short long data treasuries and he was long Commodities and if you had put those two trades on at that time and held them to today you would have made fortune and so I think he’s extraordinary in his ability to kind of see macro in a way that others don’t but also to take extremely brave action with his portfolio he’s renowned for how big the bets are that he makes and how quickly he can change his mind when he’s wrong and make another big bet to and still get himself out of the hole he’s incredible so I definitely give it to Stanley Diller this year on a dollar basis the biggest business loser was big Tech and I think that you saw three things happen which I think are important for the future the first was it was the most crowded trade both by professional money managers as well as retail and that fever finally broke you’re seeing a lot of panicked selling to cover losses and other things so I think that number one that happened number two Regulators basically said we’re going to go after these guys every single which way we can and then number three I think it started to change the Innovation cycle where people now actually believe that they can’t outspend because folks won’t tolerate it and the things that they’re spending their money on seemed kind of foolish the FED trying to play catchup is the worst trend for me over steering into the crash we have record deficits record debt adding another $1.65 trillion of spending that nobody can seemingly account for we have not gotten religion yet around being measured in how we spend money the government colluding with big Tech to engage in censorship this is how they’re going to do the authoritarianism we talked about it with shellenberger and Elon this whole series of Revelations known as the Twitter file we can see this collusion this cozy relationship between the censors at Twitter and big Tech and the bureaucrats at the FBI and DHS and Pentagon this is a really disturbing dystopian relationship as we talked about it earlier and you know I feel like we spend all this time talking about the authoritarianism in Russia and China we seem to be obsessed with combating that and going to war with that but we don’t spend enough time talking about this growing authoritarianism at home the media doesn’t seem to want to report on the Twitter files at all let’s focus on stopping authoritarianism here my worth trend is what I would call interest rate Mania and I think that this is the Mania that we’ve been caught up in on this show that other people on our thread people in the business community and the investing Community where everyone’s obsession with did the FED act soon enough or late enough and that interest rates ultimately Drive success or failure with building businesses and making good Investments and the truth is when interest rates go the wrong way good Investments can kind of strengthen their way can make their way through those environments bad Investments cannot good businesses can make their way through and bad Investments cannot and so I think our Mania around the fact that interest rates and the FED ultimately drove bad outcomes in businesses and Investments is a flawed kind of assertion and we all want to kind of get back to the drunken days where you know a low interest rate environment enables us all to be successful and wealthy and I think that that’s kind of changed so I think it’s time for us to get away from the interest rate media and focus more on solid investing and solid businessWelcome to Big Money Investing – Your Ultimate Destination for In The Money Facts!

🌴 Discover the Big Money Investing Strategies on Metals and Real Estate Investing. 🌊

Experience the world of finance with Big Money Investing. We bring you the latest and greatest from Big Money Investors, showcasing the whys, how-to’s, and best practices. Whether you’re planning a short—or long-term investment, preparing is the first and most important step. The Big Money Investing channel is a great go-to investment advice source

🔥 What You Can Expect:

- Exclusive Financial and Big Money Investing How-To’s

- Big Money Financial Traits: Learn how to mix and match your perfect investment portfolio to match the planned-out time horizons.

- Financial Learning Is A Lifestyle Change: Stay financially fabulous with our expert investing tips, real estate practices, and healthy lifestyle advice.

- Behind-the-Scenes: Get a sneak peek into how the Big Money Investors spend some of that return, from photoshoots to interviews with the experts.

👙 Why Subscribe to Big Money Investing?

- Stay Updated: Be the first to know about new investment ideas and most importantly what not to be part of in today’s age.

- Inspired Goals Lend Motivation: Get inspired by our Big Money Investors’ vibrant and diverse lifestyles, a perfect view at times.

- Engaging Community: Join a community of financial enthusiasts and wealth producers who love to share their passion for life with others.

🔔 Subscribe Now: Hit the subscribe button and turn on notifications so you never miss an update from Big Money Investing. Join us on this fabulous journey and transform your financial situation with the latest trends and tips from Big Money Investing. Thank you for being a part of our amazing community.

#BigMoneyInvesting #big #money #investing #lifestyle #investors

Support Big Money Investing Sponsors

-

Book Sets, Books, How Big Money Investors Think About Money, How To Think Like A Big Money Millionaire

Big Money Financial Investment Management Book Set

$85.44 – $177.66Select options This product has multiple variants. The options may be chosen on the product pageQuick View -

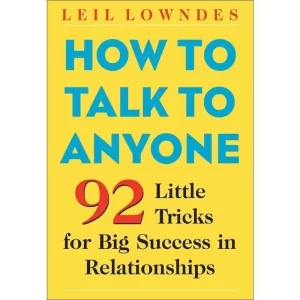

Books, How To Think Like A Big Money Millionaire, Top Level Communication Skills

How to Talk to Anyone by Leil Lowndes 92 Little Tricks for Big Success in Relationships

Original price was: $18.24.$12.89Current price is: $12.89.Select options This product has multiple variants. The options may be chosen on the product pageQuick View -

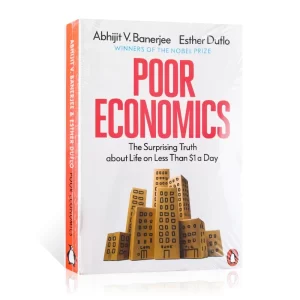

Books, How To Think Like A Big Money Millionaire

Poor Economics By Abhijit V.Banerjee

Original price was: $18.09.$12.14Current price is: $12.14. -

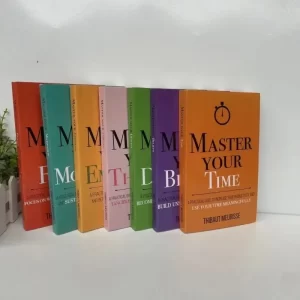

Book Sets, Books, How Big Money Investors Think About Money, How To Think Like A Big Money Millionaire, Spiritual, Wealth Creation

7 Book Set – Master Your Time – Master Your Beliefs – Master Your Destiny – Master Your Thinking – Master Your Emotions – Master Your Motivation – Master Your Focus By Thibaut Meurisse

Original price was: $93.43.$67.33Current price is: $67.33.

Leave a Reply