“USA Collapse Is Far WORSE Than You Think…” — Peter Schiff’s Last WARNING

Video Transcript

Subscribe To Big Money [Music] I’ve tried my best to warn people things are going to be so bad this financial crisis that we’re headed for is worse than the one we had in 2008 it’s going to make 2008 look like a Sunday school picnic take your money out of the bank don’t leave it there you’re going to lose it one way or the other they don’t care about the country they care about themselves stocks are so extremely overpriced right now they have to collapse any day you go to sleep you could wake up and it could be a whole new world we screwed the world over in 1971 we defaulted on our commitment we promised to pay gold and then we told our creditors we’re paying nothing we basally just said these checks are no good we made a commitment and we’re defaulting on it now the dollar went down a lot during the 1970s it lost about two-thirds of its value relative to other Fiat currencies like the deut marize them when the US broke the relationship to Gold why didn’t a currency rise at that moment that was tied to Gold there really weren’t many currencies left that were still tied to Gold because they were tied to the dollar and then the dollar dether you know from gold but what happened was the dollar lost a lot of value during the 70s right the Swiss went from 25 cents to 75 cents the end it went from 360 n to the dollar to maybe about 150 I think the deut Mark we used to get four marks to the dollar then it went down to like one one and a half the dollar got marked down oil went from $3 a barrel to $30 a barrel in the 70s gold went from 35 to 800 right so the dollar lost a lot of value and that meant every American got poor in the 1970s that’s the main reason that so many women started working in the 1970s you know during the 1960s if you were a married woman most of you didn’t have a job your husband could support you it didn’t even matter what kind of job bluk collar job he supported his wife but inflation was so high and people’s money lost so much value that in order to pay the bills the wife had to get a job it wasn’t like oh women felt liberated so they decided to work they were liberated when they didn’t have to work they were forced to work because their husbands couldn’t support them anymore because of the inflation but the dollar did stabilize in the 80s you know with the very high interest rates under vulker rates went to 20% you know and Reagan came in and you know we kind of like saved the dollar got a reprieve but now I think the doation is going to be complete because the other thing that happened to support the dollar was the Petro dollar so what happened is we went off the gold standard so there was no longer any gold we made a deal with Saudi Arabia to price oil in dollars say Hey you know we’ll defend you we’ll defend your regime we’ll keep your enemies at Bay you just price your oil in our currency so now all of a sudden we did create a use for the dollar because if you wanted oil which everybody wanted you needed dollars to pay for it so that also really helped support the dollar but the Petro dollar now unless you’re blind is on its way out a lot of these countries are trying to figure out how bilaterally deal oil in currencies other than the US dollar when the world moves away from the dollar totally then the collapse is going to continue it started in 1970 it’s going to continue we’re going to see a huge erosion of purchasing power but it’s going to be even worse the economy today the US economy is in much worse shape than it was in 1970 I mean we were a creditor nation in 1970 even in 1980 we were still a creditor nation that meant the world owed us a lot more than we owed the world today not only are we the biggest D Nation we owe more money than all the other D nations in the world combined back even in the mid1 1980s America still had trade surpluses our factories were productive enough that we exported more than we imported now we have the biggest trade deficits in the world biggest trade deficit ARA so the economy is a shadow of what it was why does Deb matter what’s the problem if you get into trouble do you want to have you know a nest egg to fall back on we save for a rainy day right you don’t borrow for a rainy day why do you build up a rainy day fund so you have something to fall back on if times are tough but if you’re broke if you have nothing what are you going to do we are vulnerable we’re no longer self-reliant the way we used to be I mean the economy is all screwed up and I think that the decade ahead is going to be a lot more challenging than was the 1970s it’s going to be a much bigger adjustment obviously women can’t start working they’re already working so it’s not like we have a spare laborer that can pick up the slack like we had back then we have more technology now that’s a positive and now the whole Spectre of AI that could help out I mean that could help increase productivity there I just don’t think it’s a get out of jail free card that it’s going to be like a miracle thing but I think it’s going to help and a lot of other technologies that we have will help but the problem is government because I’m afraid that instead of getting out of the way which is what you need right we’re in a mess capitalism is our only way out the free market we could work our way out of this hole right that the government put us in but if the government reacts to this problem with even more government more regulation more spending there’s no way out we’re just going to be impoverished until there’s a violent revolution who knows when that’s going to be can you imagine any scenario where government actually gets smaller yes only in a scenario where things get better because it’s actually inversely proportionate Prosperity is iners diversely proportionate to the size of government the smaller the government the more prosperous the society and the bigger the government the less prosperous you know you compare you have countries where they split it East Germany West Germany South Korea North Korea right you know look at these countries where you take the exact same society and just cut it in half and you have one that’s socialist and one that’s more capitalist which one has a higher standard of living which one does better who did better communist China or Taiwan or Hong Kong you know China didn’t start doing well until they started adopting free market capitalism if you go back to the 1970s and say hey where was it better in mainland China or Taiwan Taiwan it was better in Hong Kong why because mainland China was run by the Communists it wasn’t until really the 1990s that the Communists realized that communism doesn’t work they didn’t come out and tell the people it didn’t work because you still have the Communist party but they started changing the nature of the economy to allow entrepreneurship to allow private ownership of the means of production that’s what made China what it is today it was as capitalism came into I’m not defending communism all I’m saying is that as China became more capitalistic their standard Living went up before they did that there was a lot more capitalism in Taiwan or in Hong Kong you had the same basic you know Chinese people there but they did much better their living standards were much higher until we have a lot of pain and suffering nothing’s going to change and as long as the government can bail everybody out by printing money they’re going to do it if I’m right and I’m convinced that I am and we have massive inflation that hopefully doesn’t become hyperinflation but it could things are going to be so bad that people may finally have enough of a belly full of government that they just puke it all out and that a message of economic freedom actually works some people like me and other people and we have the internet and we have a way of communicating to let people know hey the government did this the government is not part of the solution the government is the problem right that’s what Ronald Reagan used to say right the government isn’t the solution the government is the problem you have already done the inflation the person has been shot they are bleeding out but somehow they don’t recognize yet that they have been shot so inflation is coming for you as the FED tries to manage that inflation by raising rates they’re probably going to check it out they’re going to try to cut or something the second they try to cut inflation is going to rear its ugly head again then as inflation starts happening and they realize that they’re no longer going to be able to cut rates you’re going to start raising rates as they raise the rates to try to Tamp that back down then treasuries are going to take off bonds are going to tank we’re going to see interest rates going up people are going to leave the stock market because it’s going to be very hard for you to get that kind of yield that you can get in a treasury bill which is nice and safe just park my money with the government it’s yielding copious amounts of money and when that happens they’re also going to flee Regional banking now this is where the scary part starts as they flee Regional Banks which are insolvent as far as I can tell Regional Banks then are going to be they’re going to start collapsing the government’s going to step in they’re going to print the out of money they’re going to inflate it again and as they inflate the money supply they’re going to have to raise rates again which is going to pull people out of regional Banks even faster it’s going to pull people out of the stock market so everything consolidates into like four way too big to fail Banks the stock market struggles for God knows how long and now everybody’s putting put their money into T bills but that’s the government that you’re now betting on and if you’re right and dollarization is happening like crazy the brics nations are creating a new currency or threatening to that’s backed by gold and so now your own thesis comes back to haunt us As Americans and people like holy you’re inflating this thing to deal with the regional banking collapse and now we’ve got oh hey this other sey thing over here which is backed by gold I think people also going to flee into Bitcoin they’re going to flee to things that they see as backed by something quote unquote real we’ll stick with gold for now not to get into an argument and that’s how the collapse happens and no one wants that to not happen more than me but that’s one flavor of how that could play out there’s a lot there but first of all I think you probably have a better understanding of the problem than a lot of people who have Nobel prizes in economics so don’t you know sell yourself short because you have common sense which a lot of professional economists don’t have but also unfortunately we actually need a collapse is so it’s not like we should say you know you don’t want one it’s like we don’t want it to be as bad as it’s going to be but it’s like you know in California those tremors are a good thing because having Tremors means you don’t have the big one there are imbalances that we need to have like you need forest fires if you don’t have some then eventually you have a really big one right so we have problems in the economy they have to be Unwound the sooner the better we’re going to have to go through some pain if we want gain I mean it’s just it’s inevitable but let me go back to beginning of what you’re talking about so first of all yeah the FED has been raising rates in an effort supposedly to fight inflation but it doesn’t work the only way that higher rates impact prices in inflation is if they encourage people to save more and spend less that’s the whole purpose the prices are going up because we’re buying stuff and so the FED is supposed to raise rates to discourage us from spending and causing us to save more so now the savings we can have you know more production but that hasn’t happened even though the FED has raised rates the savings rate has collapsed and credit card debt is at a record high government debts are at a record high so the fed’s rate hikes have done nothing to impact savings and spending so they’ve done nothing to bring down inflation what they have done is increase costs because when prices do go up I mean when interest rates go up everybody who has debt including all businesses who have debt now have to pay higher interest on that debt that’s the same thing as paying higher wages to your workers higher rent to your landlord it’s another cost that ultimately gets factored in the Fed was artificially suppressing those costs for years and years and so businesses were able to pass that on to their customers but now that interest rates are normalizing they have to raise prices to make up so it’s actually been adding to inflation the reason that we’ve had a come down in inflation because of the rate hikes is the rate hikes caused the dollar to go up because as the FED started hiking rates currency Traders bid up the dollar and they expected rates keep going up the dollar had a big rally and that brought down oil prices oil prices went way down other commodity prices went down because the dollar went up that’s what temporarily brought down the CPI that is all changing that’s stopping the dollar has topped out and it’s headed lower commodity prices have bottomed out they’re headed higher so we’re going to lose that benefit we’re going to start to see prices rising again and the rate Heights have done nothing because the only way we’re going to get to the root cause of inflation is if we cut government spending dramatically and that’s not happening government spending is going up the FED is is going to go back to quantitative easing they’ve already showed their hand with these last bank bailouts and by the way years and years ago exactly what happened to these Regional Banks is exactly what I predicted would happen exactly like I got the 2008 financial crisis I nailed this on Thee I said for years as the FED held interest rates low you this was a ticking Time Bomb for the banks because I said the banks are going to be stuck with all this low yielding debt and when interest rates eventually rise they’re going to go broke you had all these other analysts that were saying oh buy the financials because interest rates are going to go up and that’s going to help the financials I was like a lone voice saying no higher interest rates are going to be the death nil for these financials look people were talking about mortgages right hey everybody is refinancing their mortgages everybody’s getting a 3% three and a half% mortgage isn’t that great because you know the homeowners can pay these low mortgages for the next 30 years I was the only person out there in the financial Community saying wait a minute what about the lenders what about the banks who are going to be stuck with the paper they’re clipping these coupons for 30 years what happens when interest rates go to 5% 6% 7% and they’ve already loaned out all their money at 3% they’re all insolvent which is what they are why do you think your bank go to your bank Bank of America Wells Fargo see what their deposit rates are see where their CDs are they’re paying nothing they can’t afford to pay you any money because they’ve already loaned it all out it’s stuck they’re all insolvent they’re all going to collapse what’s going to happen is the fed’s going to end up bailing them out with inflation so you’re not going to lose your money but your money is going to lose its value all this is going to happen and the situation that you described the piper is going to have to be paid here but the best thing you could do if you want to try to save yourself financially but also maybe have a positive impact on the rest of the world don’t go broke don’t go down with this ship get off the ship get in a Lifeboat so that when everybody else is drowning you can reach in and pull them out preserve your own wealth and the way you do that is take your money out of the bank don’t leave it there you’re going to lose it one way or the other do something with it you could buy gold you can invested productively outside the US you could buy quality stocks that pay good dividends that will rise with the falling dollar that will also go up with inflation because the businesses are selling things where they have pricing power in an inflationary period you want to be in a business where you’re selling stuff that people have to buy not the stuff that they stop buying because they can’t afford the stuff they have to buy so there are certain types of companies that you want to own and we own those companies and they’re paying good dividends and that’s the first thing we can’t do anything to stop this I was powerless to stop the 2008 financial crisis but I could try to figure out how to profit from it I can’t do anything about this I’ve tried my best to warn people I’ve been out there I’ve testified before Congress twice I wish I could have gone there more often but nothing I say matters to these guys because again they don’t care about the country they care about themselves they care about getting reelected everything that they would have to do that was right for the country jeopardizes their re-election the only way they can stay in office is to do what’s wrong for the country that’s their Paramount concern is perpetuating their political careers not helping the country so all you can do is save yourself at this point there’s not enough of us who are going to figure this out to have any influence on the next election but we can protect ourselves there were people that made money in the 1970s with all that inflation most people lost the a ton of money during that decade but a few people who read the writing on the wall were positioned properly and they cleaned up in the 1970 I think the same thing is going to happen in this decade I think I’m extremely well positioned and I think everybody who’s been following my advice I mean sure I’ve been giving this advice out for a while so I’ve been early but I know that I’m right and the fact that we’ve kicked and canned down the road for as long as we have simply means that it’s that much more important to be positioned this way because the bubble has gotten much bigger so yes I had to wait a little bit longer to get paid but I think it’s a bigger payday because the problems that I was worried about a decade ago none of them have been solved they’re all much worse and so now the Fallout is going to be much greater and so the losses for the people who don’t anticipate this and position those themselves properly those losses are going to be greater and yes people need to own gold people should take advantage of that and buy gold it’s still about $1,900 an ounce that may seem like a high price but I think it’s actually very low relative to where it’s going to be and again it’s not gold going up gold pretty much stays the same it’s the dollar that’s going down you’re going to need more and more dollars to buy that ounce of gold and so if you want to preserve your purchasing power you convert your dollars the gold now and then when you need to buy something in 5 or 10 or 20 years you’ll be able to afford it if you just keep your money in cash you may not be this stuff is terrifying and I really wish I didn’t have to think about this to that point Michael bur who predicted the housing crisis along with you he’s one of the rare voices that was like Hey this bad thing is coming he just bet essentially is a way to look at it $1.6 billion I’ll call it against the stock market have you looked closely enough of that to know what is he really trying to say with that bet he may make a lot of money and it’s all leverage so he didn’t basically put up 1.6 billion he put up a much smaller amount and he’s willing to lose it if he’s wrong right but he’s probably controlling with leverage or options or whatever I haven’t looked at the way he’s constructed that position I know I thought myself a few weeks ago I mean even near the highs about maybe I should you know get short the stock market I’ve been short the bond market not in a big way like that but if the FED did the right thing and if they do the right thing he’s going to clean up on that position If the Fed does the right thing the problem is the Fed might cave and do the wrong thing in which case he’ll lose but I don’t know what the of his bets are because given where interest rates are and where they have to go and given what’s going to happen to corporate earnings stocks are so extremely overpriced right now they have to collapse the only way they won’t is if the dollar goes down instead If the Fed is willing to sacrifice the dollar to save the stock market and to bail out the US government then they might do that right the FED may decide to change its rhetoric okay we’re done hiking rates or they might cut rates or go back to QE in an official way and the Market’s going to Rally if that happens you know but in real terms the Market’s not going to Rally because the dollar I think will lose more value than the stock market gains when you’re buying puts or you’re doing some of these shorts It’s nominal that’s what matters so if gold goes from 1900 to 3,000 and the stock market you know goes up 10% in real terms the stock market got killed but you’re going to lose on your short right because it’s all about the nominal price when it comes to a short not the real price so for my money I know that no matter what the fed’s going to eventually do the wrong thing but even if they do the right thing in the environment where they do the right thing the price of gold is still going to go up I just don’t really see any scenario where it goes down and I don’t really see any scenario where the dollar goes up I mean it could go up in a short run but in the long run it has to go down I mean there’s no way this thing is going to shake out where the dollar has more value and not less value I mean you could make money short but you could end up losing money in the long run depending on what happens with inflation but I think that for most people being long the underpriced assets that will benefit from these events as they play out is probably a better way to play it than to just make a short-term speculative bet on the direction of the stock market where you could end up being wrong and losing it’s very hard to get the timing right I think the market looks weak I mean if I had a place a bet on where I thought the market was going to go I would bet it’s going lower so Barry’s made that bet we’re still very close to the highs there’s a lot of air to come out of this especially in the NASDAQ especially in a lot of these tech stocks that have had really big rallies but again it’s hard to know what the government’s going to do and when they’re going to do it to try to you know put a bandaid on this because they could change policy the FED could just reverse if they start to see the markets really coming under pressure if they see some blowups in the banks again money market K because you know this commercial real estate problem which I also warned about years and years ago is playing out the way I warned I mean commercial real estate prices are already down in many parts of the nation by 50% or more I knew that interest rates would eventually go up because real estate prices are a function of interest rates especially incom producing commercial property they kind of trade like a bond when interest rates are really low it affects the cap rates on Commercial Real Estate so people were willing to overpay for real estate in an environment of 0% interest rates I knew eventually rates would go up and then commercial prices would have to go down just like I new bonds would come down and so that’s going to put problems and I also could see what was happening with the internet and more and more people buying online and so there wasn’t as much need for all this retail space people weren’t you know going to the stores they were just clicking a mouse or on their smartphone but with Co it accelerated it yeah I didn’t see that aspect coming of it I already knew that it was going to be bad just Co made it that much worse you know it just took a bad situation and made it an even more horrific situation but as real estate owners are losing a lot of money on their commercial real estate a lot of those losses are with the lenders because if the real estate is not worth the loan then the owner just walks away and the bank is stuck with the collateral that isn’t worth what they loaned and now they have huge losses that they have to deal with on their books and with all this Supply on the market in fact I was particularly warning about what was going with wework back in the day when wework was like buying up all this office space and committing itself to long-term leases and then renting out shortterm I was predicting the demise of weor long before it demised it collap but I also was saying that how it’s going to impact the property Market when all their property comes up for lease or comes up for sale this commercial real estate problem is a banking problem and the banking problem means it’s an inflation problem because how do you bail out the banks you have to print more money your residential Market is also completely dysfunctional disaster what’s happening in residential markets and I predicted this years ago if you listen to my podcast I mean I talked about all this stuff years ago I mean it wasn’t like I’m reacting to it after it happens I warned about it years before it happened so I predicted that a big problem in the real estate market apart from all these banks that were going to be underwater that were stuck with these loans but I said that Americans who have mortgages are going to be stuck in their home because they’re not going to be able to sell because the mortgage is in assumable so let’s say I have a 3 and a half% mortgage and now mortgage rates are 7 and half 8% and they’re headed higher I can’t move I can’t sell my house because then I’d have to take on a new mortgage most Americans if you’re a homeowner your most valuable asset is your mortgage because you have the right to keep paying that mortgage for the next 20 25 years 30 however many years you got the bank is losing a fortune on that mortgage you’re making a fortune so people are going to stay in homes even if they rather have a bigger home or a different home they’re stuck where they are now maybe they could rent it out you know and keep the mortgage but a lot of the housing stock is off the market now because nobody is going to get rid of it because that’s tied to their mortgage and in many cases rents are rising so fast that paying your mortgage is cheaper than paying rent if you’ve got one of these the low was 2 and 58s I think there are people that got mortgages below 3% you know during like Co days so those people are never selling they’re there right they die their kids will keep the place they have to keep that mortgage so you don’t have this housing stock meanwhile landlords know that those houses aren’t coming up for sale they got a captive audience their tenants can’t afford to buy anymore because the rates are so high so they can jack up the rent eventually home prices have to collapse what’s keeping that from happening is an absence of Supply but at some point people are going to die you know people get divorced I mean there’s going to be circumstances people lose their jobs and even though they have a low mortgage they can’t even afford to pay that right so there’s going to be housing that’s going to come on the market and then the price is going to implode because nobody can afford to buy the houses at these high mortgage rates I mean the reason real estate prices went up so much is because the mortgage rates went down so much because people didn’t buy price they bought the monthly payment that’s what was the deciding factor on what they can pay and the monthly payment was determined by the race now also the absence of a down payment so down payments went from 20% down to zero I mean they’ve come back up a little bit I think the average down payment now is more like 5 or 6% but that’s like nothing because it costs 5% to sell your house you got to pay the real estate agent the commission but the absence of lending standards and a lot of that was because of government guarantees and Fanny and Freddy and all this stuff I mean people encouraged to overpay for homes that they really shouldn’t have bought and I think it’s important that people put up a down payment when they buy a home they need to have some skin in the game they need to demonstrate the ability to save money because as a homeowner I know that real estate is very expensive you own a house things go wrong they’re like money pits they cost a lot of money if you’re a renter that’s your landlord’s problem you just pay your set Rent you don’t have to worry about any unanticipated major expenses Americans don’t have money for unanticipated major expenses so the banks did a good job when they required 20% down you know to making sure that people didn’t buy houses unless they were responsible enough to take on the liability but the government incentivized everybody to buy houses and overpay and you get tax breaks and government guarantees and so the government caused people to buy houses that shouldn’t have bought them but the point I’m making now is that eventually real estate prices are going to fall they have to if rates stay up and now there’s defaults and now the banks are going to lose money on their residential real estate loans in addition to their commercial and I think you’re going to see a wave of defaults in credit card debt I mean right now credit card debt is at a record high interest rates on credit card debt are at a record high it’s over 20% if you’ve got a balance on your credit card and you’re paying over 20% interest and you have record balance there’s going to be waves of defaults in credit card debt in fact I think what people are doing now who have credit card debt before they default they’re just running up as much debt as they can because if you know that you’re going to default and go bankrupt you might as well go out with a bank right the more money you can borrow while you can the better buy as much stuff as you can on credit and then default so I think we’re going to see a wave of default in credit cards and what does that mean that means the banks are going to lose because they’re not going to get that money back they’re going to have to write off all those losses so it’s just more money printing I mean this financial crisis that we’re headed for is worse than the one we had in 2008 it’s going to make 2008 look like a Sunday school picnic which is why I think we’re going to have a dollar crisis instead the FED is not going to sit back and let all this happen they’re going to think they can make it all go away with massive quantitative easing more money printed because hey it worked before it worked in 2001 it worked in 2008 it worked during covid so we’ll just do it again well you know what it’s not going to work this time it’s like you can only take so much of a drug until you die of an overdose and every time we did more of this monetary her we had to up the dosage because we kept upping the problem but it’s so big right now that if the FED tries to drug us up again the amount of monetary that would be required would kill us and that’s kill the dollar and everything’s going to come popping down think about this so we have a $32.7 trillion national debt which is Rising by trillions of dollars a year as of today interest on the national debt is now the third biggest line item in the budget so number one is Medicare then Social Security then interest on the debt then National Defense we’re actually spending more to pay interest on the money we borrowed than we’re spending on defense and of course I think we’re spending too much on defense I think we should spend less but we’re spending more on interest but here is the real problem that number keeps growing a couple of years ago interest on the national debt was 300 billion a year now it’s over a trillion by the end of the year it’ll be two trillion what you know in three or four years the US government will be paying more in interest on the national debt than it collects in taxes so I mean this is impossible because the only way around that is that the FED slashes interest rates but what if they can’t what if they have to keep rates where they are the government must default there is no way that it can afford to make these payments because if fed would have to print so much money to monetize that debt that it would create so much inflation that it would push interest rates even higher the more inflation there is the less private sector demand there is for government debt but the more money the FED prints to prevent interest rates from rising the more inflation they create and the less attractive the government debt becomes and now the FED is the only buyer of treasuries but now it’s not just treasuries what about Municipal debt what about all these municipalities and states that loaded up on debt what’s going to happen when it matures and they have to roll it over at much higher rates what about all these corporations that borrowed a bunch of money to buy back their own stock what’s going to happen when that debt matures and now they have to try to refinance it and the rates have tripled or quadrupled for them everybody is going to collapse look the problem is we need higher interest rates higher interest rates is part of the Cure but it’s also what’s going to kill the current economy you can’t get rates from where they are now to where they need to be without a collapse it’s like you can’t make an omelet without breaking eggs well we’re going to break a hell of a lot of eggs because of how much debt we have why do we have so much debt because we had 20 years of artificially low interest rates of punishing people who saved and rewarding people who borrowed and so the whole economy is screwed up we can’t unscramble this egg it’s going to be bad but I think that because it’s going to be so bad the FED is going to choose what it perceives to be the lesser of the two evils it will choose inflation over collapse depression financial crisis bankruptcy you know just be in real assets be out of the dollar be in Precious Metals be prepared to avoid the inflation tax because that’s the tax that’s going to clobber everybody what time period is this all going to play out over I’ve sounded the alarm in the past we’re pretty much run out of time I mean we’re literally living on Farrow time so any day I just think any day you go to sleep you could wake up and it could be a whole new world and that’s why you got to be prepared during the debt sealing debate right and we keep saying we got to raise the debt sealing so we can keep borrowing and if we can’t keep borrowing we’re going to default which is an admission that we’re running a Ponzi schem ber mid said look you know the US government’s running the biggest Ponzi scheme ever I mean I’m a compared to the government right and so people would say who cares what Bernie mid says right he doesn’t have any credibility he’s a criminal and what I used to say back then was well he’s got credibility in one area and that’s Ponzi schemes he knows one when he sees one and if Bernie mov says the US government is running a Ponzi scheme he ought to know and then I used to joke and I said you know instead of putting him in jail we should make him Secretary of the Treasury because he would do a much better job of running the scheme because I pointed out that you had secretaries of the treasury like current Janet Yellen she comes out and says hey if we don’t raise the debt ceiling we’re going to default that’s an admission it’s a Ponzi scheme Janet Yellen didn’t say if we don’t raise the debt ceiling we’re going to raise taxes so we can pay our bills we’re going to cut Social Security so we can pay our bills no if we don’t raise the debt ceiling we’re going to stop paying our bills that’s why I would get a laugh they say we have to raise a debt ceiling so America always pays its bills no we need to raise a debt ceiling to continue not paying our bills the reason we have a stack of $32 trillion of unpaid bills is because we don’t pay them we go deeper into debt I used to joke and I said you know it’s Ponzi 101 when you’re running a Ponzi scheme you keep it quiet you don’t tell the people that you’re running a Ponzi scheme so at least we could have bluffed and pretended that no matter what we’re going to pay no we told everybody that the only way America is going to pay its bills is if we can find some other sucker who will lend us the money but the minute we run out of suckers and we can’t borrow well you’re so that’s basically what they admitted yeah I mean it’s a gigantic Ponzi scheme and I think the FED is going to try to prevent the government from defaulting by buying those bonds and printing the money and that means the default takes the form of depreciation of the currency because the debt is unpayable the one thing that you know for sure is the government’s not going to pay its bills it’s not going to pay the debt the only question is how does it default does it do it honestly by just not paying or dishonestly through inflation default would be much better I mean I would like to see a complete restructuring of the government where the government cuts a lot of spending including the debt I think we should basically try to negotiate or maybe 50 cents on the dollar 25 cents on the dollar it’s better to repay our creditors less money than pay them in full with inflated money where they end up with even bigger losses but unfortunately that’s the path we’re going to go down because from a political perspective nobody wants to do the truth now they just want to KI the can down the road I mean you don’t want to diffuse the bomb before it blows off you want to let the bomb explode and then point the fingers and blame it on somebody else and say that there’s nothing we could have done no nobody could have predicted this if I’m right that inflation is How This Ends it’s a lot of older people who are going to get wiped out if you’re young chances are you don’t have a lot of savings in fact you probably have no savings whatsoever inflation is not can affect you in that way and you’re still out there working you can earn more money to cover the fact that costs have gone up but if you’re older if you’re retired if you’re living off Investments you get decimated you know a lot of people say oh you know we’re leaving all this debt to our grandkids the grandkids don’t have to pay it I mean they can leave in theory we’d have to raise taxes massively on the younger generation to pay off the debts of their parents and grandparents but what if they just leave if somebody owes money they owe it to somebody else so somebody is a debtor and somebody is a creditor so when inflation wipes out debt it wipes out the Creditor as well who is the biggest debtor on the planet Earth the US government and so the US government actually has the most to gain from inflation that’s why it creates it the government wants inflation they just don’t want us to realize that they’re creating it and they don’t want it to get out of hand but it will get out of hand the monster is going to end up beyond their controlUS Financial News

US Financial News delivers good insights and news about investing, particularly regarding wealth generation in the metal, real estate, and cryptocurrency markets.

- Understanding Market Trends in Metal Investing

- Evaluating the Long-Term Potential of Real Estate Investments

- Identifying Key Indicators for Profitable Cryptocurrency Trades

- Diversification Strategies for a Balanced Investment Portfolio

- Analyzing the Impact of Global Economic Events on Metal Prices

- Exploring Emerging Real Estate Markets for Investment Opportunities

- Managing Risks in the Volatile World of Cryptocurrencies

- Leveraging Technology for Smarter Investment Decisions

- Comparing Traditional Investments with Modern Alternatives

- Building Wealth through Sustainable Real Estate Practices

- Predicting Future Trends in the Cryptocurrency Market

- Understanding the Tax Implications of Metal Investments

- Navigating the Complexities of Real Estate Crowdfunding

- Creating a Long-Term Investment Plan with Cryptocurrencies

- Assessing the Environmental Impact of Metal Mining on Investments

- Finding Reliable Sources for Real Estate Market News

- Staying Updated on Regulatory Changes in the Cryptocurrency Industry

- Understanding the Role of Blockchain Technology in Metal Trading

- Evaluating the Pros and Cons of Different Real Estate Investment Models

- Developing a Strategic Approach to Multi-Asset Investing

We try to help individuals navigate the complexities of investing in metals, real estate, and cryptocurrencies.

Thank you for being a part of our amazing community.

We can’t wait to see you shine finanically!

#BigMoneyInvesting #big #money #investing #lifestyle #investors

Support Big Money Investing Sponsors

-

Book Sets, Books, How Big Money Investors Think About Money, How To Think Like A Big Money Millionaire

Big Money Financial Investment Management Book Set

$85.44 – $177.66Select options This product has multiple variants. The options may be chosen on the product pageQuick View -

Books, How To Think Like A Big Money Millionaire, Top Level Communication Skills

How to Talk to Anyone by Leil Lowndes 92 Little Tricks for Big Success in Relationships

Original price was: $18.24.$12.89Current price is: $12.89.Select options This product has multiple variants. The options may be chosen on the product pageQuick View -

Books, How To Think Like A Big Money Millionaire

Poor Economics By Abhijit V.Banerjee

Original price was: $18.09.$12.14Current price is: $12.14. -

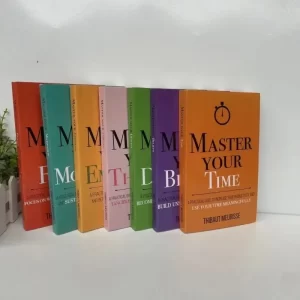

Book Sets, Books, How Big Money Investors Think About Money, How To Think Like A Big Money Millionaire, Spiritual, Wealth Creation

7 Book Set – Master Your Time – Master Your Beliefs – Master Your Destiny – Master Your Thinking – Master Your Emotions – Master Your Motivation – Master Your Focus By Thibaut Meurisse

Original price was: $93.43.$67.33Current price is: $67.33.

Comments (36)

You can't eat gold. If there is no food, you can't buy it.

This video is worth gold I’ve been following Peter Schiff since 2008 everything is very accurate

The fact you had to bleep out the word sexy is INSANE

Whoever don’t own a house right now, will most likely never own a house their whole life

Why did you

Bleep

Heroin?

Algorithm?

🙄

Evil has always ruled.

You people that vote you vote for your own demise.

Everything is planned out well in advance..

This time it's called Agenda 2020 2030 2050

I hope all my shit from amazon gets here before the collapse.

Its not "communism" when robots could do 90% of the work… just like its not "capitalism" when greedy d-bags refuse to pay employees alivable wage. 😂

The 70s is IN NO WAY comparable to what we could accomplish working as A TEAM today.

The existence of money only promises corruption and dystopia. School should be free so EVERYONE can have their dream job.

🎹 🎹 🎹🎹🎹

June 10, 2024, Saudi Arabia official did not renew the contract to use the US Petro dollar to buy its oil. Saudi can not sell its oil in any currency.

Peter has been crying wolf for 2 decades now. He keeps kicking his prediction down the road. Something is eventually going to happen. That we know.

He made Reagan out to be the "good guy" in all of this. Look at the country's debt and when it started running deficits. The deficits started under Reagan. That's how he took the STAG out of stagflation and the double digit interest rates set by the Federal Reserve took care of the inflation. It worked and ever since then EVERY president ran deficits and added to the debt. The only one who balanced the budget was Bill Clinton. There was a surplus at the time and we all got checks. He proved it could be done. Peter has been crying wolf for well over a decade now. The dollar is still strong. Inflation is a killer but I don't think it's likely the dollar will collapse. The other countries are in similar financial shapes. China being the worst. The two major economies are saddled with the biggest debt and what currency is stronger than the dollar backed by a stronger economy? Peter mentions currencies from other nations that went into hyperinflation in the past. YES, because the other currencies out there like the dollar weren't in bad shape. It's how your currency ranks against other and today most nations are debtor nations with currencies printed into oblivion like the dollar. Peter has been an advocate for gold for as long as I can remember. Gold hasn't performed even close to stocks and real estate. It now has competition too as an inflation hedge. Crypto currencies. Peter is part of the "doomsdayer" club. He's been on the major networks crying wolf for decades. The commentators said, "I guess a stopped clock is right twice a day." Maybe he'll be correct before he moves on from this world. Most of what he says is on the mark but I think he underestimates the power of central banks and coordinated printing. Fear is what brings up gold prices and he seems to be heavily invested in it.

I don't understand why our leaders(not all of them) talk about America and Yada Yada Yada and steadily kill our country and our way life

If the market crashes and banks collapse what’s the point of having cash?

next collapse is 2035…worried about social security.

You didn't try to warn people, You DID warn people. Most just weren't listening.

Is the USA currency only up cause of their Military powers otherwise why is their money so high for no reason when it's all printing papers and all these people talking about money are you really saying anything or just talking

If we got a single dollar everytime you annouce a collapse, we could pay off all national debt.

We are the 100th monkeys, have been, and it started with the death of JFK. Imagine if we were the 100th monkey of his gold backed dollar, just imagine. NOW we are trapped in the cesspool that has become the US government.

WE don't owe anybody anything .. the unconstitutional, illegal foreign entity known as the Federal Reserve owes the World.

🔊ENDTIMES PROPHESY'S UNFOLDS BEFORE OUR VERY EYES, SOON TO COME:

The Book of

Revelation 12-13,

14: 9-13

OUR ONLY HOPE TO ESCAPE THE WRATH AND JUDGMENT TO COME UPON THE WORLD IS THROUGH SALVATION BY GRACE IN JESUS CHRIST ALONE,

ROMANS 10;9-13

TITUS 3: 4-7

JOHN 3: 13-21

Get right with God Almigthy before it's too late 🙏🙏🙏/May God bless and protect you all ❤

Yes we know Peter !

You have warned us a 1000 times plus.

The states need to take back their independence from the federal

When a total collapse will happen Bitcoin won’t going to save you if Internet will stop working. The Gold or diamonds hidden into your shoes heels will save you to get some food. Like the jews did during the World War II.

04:05 – “…Capitalism is our way out, the free market…” – well, capitalism is not the best reliable option. The free market I agree, that’s something with good sense, but knowing how capitalism relies on the other parts of the world that are less developed, cheaper resources, cheaper labor and other things capitalism simply cannot exists without them being weaker. Imagine USA as being the entire world. Capitalism won’t exist like that. Some poor people classes will have to exist in order to make wealthier classes to live better. Hey, won’t teach you this at your US elementary or high school, people that afford to go to higher universities will learn this at geopolitics or political economy.

THE PURGE IS HERE !!!

You said this 5 years ago.

Please, who’s replacing the dollar? The renminbi? China is collapsing economically. The Deutschmark? Their manufacturing is collapsing. BRICS? Please. Our system is crippled by our fed & administration, but NO ONE out there is in better shape. Saudis are running out of oil, Brazilian is a basket case. BRICS is an alliance of cripples. Maybe Denmark. Maybe the Swiss, but both are tiny countries. Might as well have the Vatican create the reserve currency. At least they’ve had empire experience.

It’s basically termed as usery,

The government does so much unneeded and isles things so a few can gain that are involved. Then you and I pay it back. They are using us. We become slaves.

Why didn’t slaves have it good? Because someone else takes their worth and holds it from them. Using it as their own.

Stocks are priced for the money levels. To compare to previous periods you need to adjust for money levels.

I will tell you everyday we are headed to a fall. Interesting, in time I’ll be right.

Term limits….nobody should be allowed to go to DC for life.

Sometimes you guys overexaggerate I mean if the economy is doing so bad if grocery prices are so high if gasoline is becoming unaffordable for your car if you can’t buy a home because interest rates are so high if inflation is getting out of control then could someone on this board please explain to me how it is I just got back from Disney World last week And everybody knows Disney is not cheap and every single one of those parks were packed like sardines. You literally walk from one of the park to the other end of the park without stepping over people so let me tell you something there ain’t nobody out there hurting for cash I don’t see a single person hurting when I go to all those amusement parks down there in Orlando, and there was faces and people just spending cash like there’s no tomorrow that has to tell me there’s nothing wrong with this economy at all

Warren Buffet..'we'll see who is swimming naked' equals over leveraging

why is the word 'g00lag' banned by youtube?

He forgot one important detail. People did this not the government people did the youngest silent, boomers and the oldest gen X generation s